2020-09-05

At present, the semi annual reports of listed companies are basically published except for special circumstances.Lithium batteryThe industrial chain shoulders the important task of upgrading the new energy industry. As a major listed company, its harvest in the first half of the year and the trend in the second half of the year affect people's hearts.

Not to mention the host plant in the downstream of the lithium battery industry, we can see the current situation of the new energy industry by analyzing the performance of the lithium battery industry itself and its upstream lithium battery materials, lithium battery equipment and other enterprises.

Part I: lithium battery enterprises have sufficient stamina

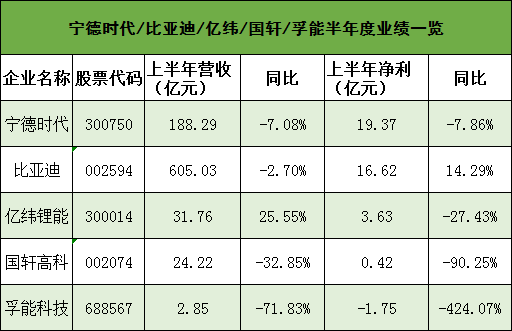

With the announcement of the 2020 semi annual report of Ningde times, BYD, GuoXuan high tech, Funeng technology and other enterprises in recent days, the business situation of lithium battery head enterprises in the first half of this year has surfaced.

Next, five enterprises, including Ningde times, BYD, Yiwei lithium energy, GuoXuan high tech and Funeng technology, are represented for analysis. The situation of the five enterprises in the first half of the year is shown in the figure below:

Figure: OFweek lithium power grid consolidation

1. Ningde Era

Although Ningde era has "double decline", the reasons behind it can let the market feel relieved.

First, in the second quarter alone, Ningde times' current net profit reached 1.195 billion yuan, a year-on-year increase of 13.27%; The second isEnergy storageExcellent performance. The sales revenue of its energy storage system was 567 million yuan, an increase of 136.41% year-on-year, which was close to the sales revenue of 610 million yuan of the company's energy storage system last year; The third is to develop the international market. During the period, the overseas revenue of Ningde era reached 2.24 billion yuan, exceeding the overseas revenue of 2billion yuan last year.

In terms of market position, although LG Chemical still ranked first in the half year, its market share fell from 27.1% in the first quarter to 23.5%; In Ningde era, on the contrary, the market share increased from 17.4% to 23.5%. In the second quarter alone, the installed capacity of LG Chemical in the second quarter was 5gwh, and that of Ningde era was 6.5gwh. It is just around the corner for Ningde era to regain the world's first market share.

In terms of stamina, 40% of supporting facilities were addedTeslaModel3, marching into the power exchange mode and other actions will make the second half of Ningde era worth looking forward to.

2. BYD

From the five enterprises in the above table, BYD is the only enterprise whose net profit increased year-on-year in the first half of the year. Moreover, BYD's net profit after deduction increased by more than 14.29% to 23.75%.

In terms of batteries, in the first half of the year, BYD's electronic components manufacturing industry (including rechargeable batteries, etc.) increased its revenue by 7.59%, and its mobile phone parts and assembly business also increased slightly by 0.24%. Widely used in mobile phones, power tools and other portable electronic devicesLithium ion batteryAnd iron battery products have become BYD's rapidly growing sector during the reporting period.

BYD said that in the first half of the year, it released and mass produced a new generation of battery product "blade battery", which passed the acupuncture test known as "Mount Everest" in the power battery safety test industry, and redefined the new energy safety standard. At present, the battery has been carried on BYD Han, new generation Tang and other models. In addition, BYD's pure electric buses are growing rapidly in overseas markets. In terms of vehicle specification level IGBT chip, BYD said it would expand to third-party users.

Mask production was also included in BYD's auto sector in the financial report. During the epidemic, BYD put into production masks and quickly became the world's largest mask manufacturer. "With the good reputation of the group's automotive business in overseas markets, the ability of global marketing services and the advantages of customer cooperation network, mask sales have made a positive contribution to the group's revenue." Obviously, the production of masks became an important profitable business of BYD in the first half of the year.

3. Yiwei lithium energy

In the first quarter of 2020, the net profit of Yiwei lithium energy increased by 25.55% year-on-year, but in the second quarter, it fell by 27.43% year-on-year. Based on the steady and rapid development of Yiwei lithium energy, there is something suspicious.

Yiwei lithium energy said that the year-on-year decline in the company's net profit was mainly due to the influence of the joint-stock company SIMORE international. If we do not consider the impact of the non recurring non cash projects of SIMORE international, the net profit of Yiwei lithium energy in the first half of the year will be as high as 816 million yuan, with a year-on-year increase of 63.08%.

In terms of power batteries, the most outstanding achievement of Yiwei lithium energy is the rapid growth of overseas sales of soft packed ternary batteries; In terms of consumer batteries, TWS bean batteries have been supplied in batches.

Looking forward to the future, with the release of the capacity of Yiwei lithium battery, the most competitive TWS bean battery seizing the market, and the simultaneous development of electric ships, electric bicycles, electric tools and other fields, Yiwei lithium energy will shine.

4. GuoXuan high tech

GuoXuan high tech's performance in the first half of the year was not optimistic, especially its net profit fell by 90.25% year-on-year.

GuoXuan high tech said that in the first half of the year, the production and operation of the company's downstream customers recovered slowly, and the company's production orders and product shipments fell to a certain extent; At the same time, the new capacity of domestic power battery manufacturers is gradually released, and the competition is becoming increasingly fierce, and the company's net profit is significantly lower than that of the same period last year.

However, looking forward to the second half of the year, GuoXuan is still worth looking forward to. First of all, from the perspective of power battery installed capacity, GuoXuan high tech has continued to rebound in installed capacity and market share since March, becoming one of the only enterprises in the industry to improve in May. In the later stage, it is expected to further improve under the halo support of Volkswagen and the hot sales of supporting models.

From the perspective of expanding new fields, GuoXuan high tech has successfully entered the market of electric ships and electric bicycles, which is expected to provide support for the recovery of future performance.

5. Funeng Technology

In terms of the first half performance statement alone, Funeng technology is worse than GuoXuan high tech, because its net profit has changed from profit to loss, and its operating income is only 285 million yuan, but its loss is as high as 175 million yuan.

But Funeng technology represents the high level of soft pack batteries. According to the semi annual report, during the period, Funeng technology invested 186 million yuan in R & D, an increase of 85.67% over the same period last year, accounting for 65.22%. In 2017, 2018 and 2019, the company's R & D accounted for 3.54%, 5.59% and 12.99% respectively.

R & D investment accounts for 65.22% of the company's revenue, and not many listed companies can come up with this data. Funeng technology said that it plans to increase the energy density of its mass-produced products from 285wh / kg to 350wh / kg in the next five years.

Looking ahead, orders from BAIC, Daimler and other enterprises will be released gradually. The potential order size is expected to be 220gwh. After breaking through the bottleneck of production capacity, it is not impossible for Funeng technology to become the king of lithium batteries.

Part II: lithium battery materials have ups and downs

In terms of battery materials, the performance of leading enterprises among the four main materials of cathode materials, cathode materials, diaphragm and electrolyte in the first half of 2020.

Figure: OFweek lithium power grid consolidation

It can be seen from the above table that among the 10 listed enterprises involved in various fields of lithium battery materials, except Enjie, the enterprise with the largest market share of diaphragm, and Tianci materials, whose main businesses were positive year-on-year with the three enterprises of new Zhoubang, the main businesses of the other seven enterprises were all down year-on-year. In terms of net profit, except for the main iron phosphatelithium batteryIn addition to the loss of German nano materials, the other nine enterprises are all profitable.

In the cathode material market, the revenue and net profit of dangsheng technology decreased the least, which has something to do with the territory expansion and achievements of dangsheng technology. It is understood that in the first half of the year, the company's overseas shipments of diversified cathode materials accounted for more than 50% of the company's total shipments of diversified cathode materials. Dangsheng technology said that if divided by revenue, three of its top five customers in the first half of this year were overseas customers.

German nano, which ranks first in terms of iron phosphate shipments, recorded a net profit loss of 70million yuan. German nano said that there are four main reasons: 1. The impact of the epidemic; 2. The price of products fell; 3. The downstream procurement demand is lower than expected; 4. Equity incentive accrued share payment funds.

Xiamen tungsten industry, with the largest increase in net profit, benefited from the optimization of product structure and the implementation of cost reduction and efficiency increase measures, and the net profit of tungsten molybdenum and other non-ferrous metal businesses increased by 191.94% year-on-year. In addition, its new energy battery materials business achieved a total profit of 94.3157 million yuan, turning losses into profits year-on-year.

In the negative electrode material market, both beiteri and Shanshan shares saw their revenue and net profit fall.

In the diaphragm market, due to the acquisition of Suzhou Jieli, the market share of Enjie shares has further increased, so the revenue has increased, but its net profit has decreased by 17.36% year-on-year, and its profitability has yet to be tested by the market. The revenue and net profit of Xingyuan material decreased.

In the electrolyte market, the head enterprise Tianci materials and new Zebang have "double harvests". For Tianci materials, its share of total shipments of power battery electrolyte ranked first for three consecutive years, accounting for 29% in 2017, 29% in 2018 and 31% in 2019. For new Zhoubang, the accelerated expansion of its overseas business and the year-on-year increase in gross profit are the support of its performance.

Part III: fierce competition in lithium battery equipment

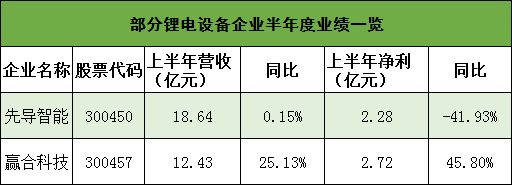

In the lithium battery equipment industry in the first half of 2020, although some enterprises also made the layout of masks during the epidemic, lithium battery equipment is the main industry. Overall, the market competition is further intensified.

Figure: OFweek lithium power grid consolidation

In terms of leading intelligence, in order to maintain the position of the first brand of lithium battery equipment, its high-intensity R & D investment since 2019 continued in the first half of the year, with a R & D investment of 304 million yuan in the first half of the year, with a year-on-year increase of 43.59%. In addition, the delay in revenue recognition is also the reason for its poor performance. However, judging from the fact that the amount of new orders received by pilot intelligence has reached a new high over the years, its strength in the second half of the year cannot be underestimated.

In terms of Yinghe technology, after actively carrying out business connection with the controlling shareholder Shanghai Electric, its product performance and quality have been continuously improved and its market competitiveness has been continuously enhanced, and good results have been achieved in the first half of the year.

Summary:Looking at the enterprises in the lithium battery industry chain, the revenue and net profit in the first half of the year mostly fell year-on-year, but among the 17 major enterprises, only Funeng technology and German nano technology lost net profit, accounting for only 11.76%. From the perspective of the future, Funeng technology is the representative of soft pack batteries, and German nano is the representative of lithium iron phosphate. These two fields are gradually increasing in volume, which is worth looking forward to.

With the weakening of the impact of the epidemic in the second half of the year and the rapid development of the new energy industry, better performance of the lithium battery industry chain is coming!

Article source:OFweek lithium grid

0755-89480969

info@powercome.hk

B1202, building 1, Mogen Fashion Industrial Park, No. 10, shilongzi Road, Xinshi community, Dalang street, Longhua District, Shenzhen

www.powercome.hk